32+ Should i borrow maximum mortgage

Ad Compare Best Mortgage Lenders 2022. Call 314 361-9979 - Its the top question potential buyers ask before starting to shop for a new home.

Warren Buffett S Ten Rules For Winning Warren Buffett Mastery Learning Inspirational Words

Ad Compare Best Mortgage Lenders 2022.

. Your annual income before taxes The mortgage term youll be seeking. Were Americas 1 Online Lender. The interest rate youre likely to earn.

Under this particular formula a person that is earning. The first step in buying a house is determining your budget. You can back into your maximum loan amount by taking the amount youve saved for your down payment and then dividing it by the percentage you plan to pay.

Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month. Your finances future plans and how much debt. To avoid being caught off guard by the slightest unexpected event keep a margin of manoeuvre of between 3 and 5 of the purchase price of your house or condo.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. So if you have.

How much income do you need to qualify for a 450 000 mortgage. Total Monthly Mortgage Payment. You may qualify for a.

Fill in the entry fields. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Calculate what you can afford and more.

Your monthly recurring debt. We base the income you need on a 450k. The banks will want to be seen as prudent Johnston said.

Input the interest rate you expect to pay on your mortgage. That largely depends on income and current monthly debt payments. Generally speaking most prospective homeowners can.

How much can I borrow. So taking into account homeowners insurance and property taxes youd be. But ultimately its down to the individual lender to decide.

To use our maximum mortgage calculator all you have to do is. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. What is your maximum mortgage loan amount.

Lenders will typically use an income multiple of 4-45 times salary per person. Home Loan - How Much Can You Borrow. Borrowing the maximum amount that you can afford will mean youll have higher monthly payments and therefore more possible risk.

Select your loan term from the drop-down thực đơn. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. As part of an.

32 Should i borrow maximum mortgage Selasa 13 September 2022 Edit. If you dont know how much your. Some experts expect buyers to be able to borrow 15 per cent more although this change is likely to be gradual.

You need to make 138431 a year to afford a 450k mortgage. This maximum mortgage calculator collects these important variables. To be able to borrow.

This mortgage calculator will show how much you can afford.

What Is The Average Down Payment For An Apartment In Nyc Nyc Buying A Condo Nyc Apartment

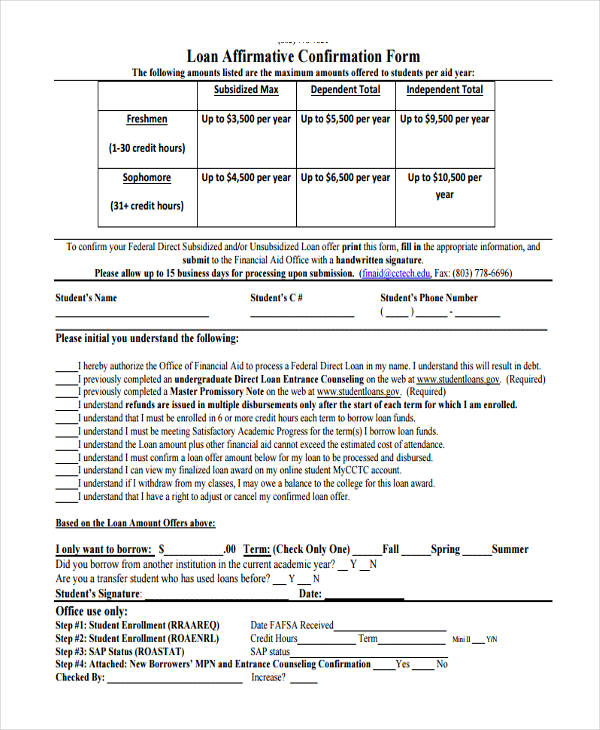

Free 8 Loan Confirmation Forms In Pdf

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

Create Your Own Dog Business Math Project In The Classroom With Kristine Nannini Math Projects Real Life Math Fun Math Projects

Pin On Finance Infographics

Ljyws6vcjuwfzm

Wondering If You Should Buy A Home Today Experts Say Home Prices Will Continue To Appreciate In The Comin In 2022 Mortgage Loan Originator House Prices Home Ownership

How I Got A Credit Score Over 800 And You Can Too Via Karenstl Future Expat Credit Repair Business Credit Repair Check Credit Score

Pin On Stockcabinetexpress Infographics

Warren Buffet S 10 Rules Investment Quotes Money Management Advice Money Saving Strategies

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

Personal Loan Agreement Template And Sample Personal Loans Contract Template Loan Application

Home Buying Board Game Home Buying Real Estate Tips Home Buying Process

Heloc Infographic Heloc Commerce Bank Mortgage Advice

How To Get A Mortgage From Pre Approval To Closing Home Improvement Loans Home Mortgage Refinance Mortgage

Know The Cost Of Waiting Or In Some Cases The Cost Of Procrastinating Interoolympics Visit Buyo Real Estate Advice Real Estate Infographic Selling Real Estate